Summary

- California's SB253 and SB261 laws mandate large businesses to disclose greenhouse gas emissions and climate-related financial risks.

- These laws impact over 5,000 companies and push for greater climate accountability.

- Understanding the two laws and their differences is key, especially as California legislation has a track record of being emulated in other geographies.

- Terrascope’s ability to create reproducible measurements all the way down to product-level can help you with all of your audit needs.

California has long been a leader in environmental regulation, and the passing of the Climate Corporate Data Accountability Act (SB253) and the Climate-Related Financial Risk Act (SB261) in late 2023 continues this tradition.

Introduction

Crucial to California's goal of achieving carbon neutrality by 2045, regulations SB253 and SB261 mandate extensive climate-related disclosures from large businesses operating in the state. As a result, thousands of organizations are expected to provide assurance-ready carbon emissions data — including detailed reporting on Scope 3 emissions throughout their value chains.

As the world's fifth-largest economy, California has a track record of reshaping business practices beyond its borders. In this blog post, we unpack the details of California’s latest climate regulations and what they mean for your business.

What are California's SB253 & SB261 climate regulations?

California's Climate Corporate Data Accountability Act (SB253) and Climate-Related Financial Risk Act (SB261) mandate extensive climate-related disclosures from large businesses operating in the state.

SB253 requires companies with annual revenues over $1 billion to report GHG emissions (Scope 1, 2, and 3), while SB261 applies to companies with annual revenues over $500 million, requiring biannual climate-related financial risk reports. Implementation begins in 2026, with third-party assurance required from 2027. Companies must submit their emissions data to a digital platform, with strict penalties for noncompliance, including fines of up to $500,000 per year. If a company is already reporting to the EU’s CSRD, they can use the exact same report for California.

Meanwhile, SB261 (Climate-related Financial Risk Act) requires large public and private companies to disclose the financial risks they face due to climate change. Starting in 2026, companies will have to submit a climate-related financial risk report biannually, in accordance with Task Force on Climate-related Financial Disclosures (TCFD) principles. Reporting companies will need to detail the physical and transition risks they face as a result of climate change, as well as the measures they’re taking to mitigate and adapt to those risks.

SB261 affects a broader range of organizations than SB253, as it applies to any corporate or business entity operating in California with annual revenues over $500 million USD.

What's the status of both in 2025?

The enactment of California’s SB253 and SB261 are a significant shift from voluntary to mandatory climate reporting, setting new standards for corporate climate accountability that will extend far beyond the state.

Recent changes with SB219 have delayed the effective date of SB253 to July 2025, although initial reporting deadlines for emissions are still set for 2026. Companies are encouraged to demonstrate “good faith” in compliance, especially during the early stages.

CARB’s delays and the lawsuits realistically mean there could be delays, changes, or even potentially withdrawals of the reporting requirements. Their delay highlights the importance of 2025 for regulatory compliance, as companies now have less time to adapt to CARB's rules. Early preparation through data management frameworks and supplier engagement is essential.

While there are efforts to delay full implementation, the significance of these laws extends beyond California, as they shift corporate climate reporting from voluntary to mandatory. Companies can anticipate increased scrutiny on Scope 3 emissions through SB253 and SB261, prompting reevaluation of their entire value chain.

In all of this, California's SB253 and SB261 presents a distinct opportunity for California-based companies to unlock positive business impacts such as:

- Effective management of emergent climate risks

Climate risks are critical for companies operating in California, with extreme climate events impacting productivity across crops, meats, and fisheries. Accurate climate disclosures such as those required by California’s latest climate laws will equip business leaders and investors with vital information for informed decision-making to safeguard and improve financial stability. - Solving for future global reporting compliance

By establishing strong climate reporting capabilities with audit-ready carbon accounting to comply with California’s rigorous standards, companies can position themselves to meet comparable emerging regional regulations, such as the European Union’s Corporate Sustainability Reporting Directive (CSRD). - Building green credentials

Companies that measure and mitigate emissions can leverage California’s reporting framework to showcase reduction initiatives and earn investor trust. Aligning with frameworks like IFRS S2 also grants access to green finance, crucial for sustaining and expanding operations in global markets increasingly focused on decarbonization and sustainability. - Uncovering opportunities for value creation

The accurate carbon accounting mandated by California’s climate laws can help companies identify and address high-emission areas, uncovering opportunities for cost savings, operational efficiencies, and innovation. Prioritising decarbonisation can also enhance competitiveness by attracting customers committed to reducing their carbon footprints.

How Terrascope can help your company meet California's climate laws

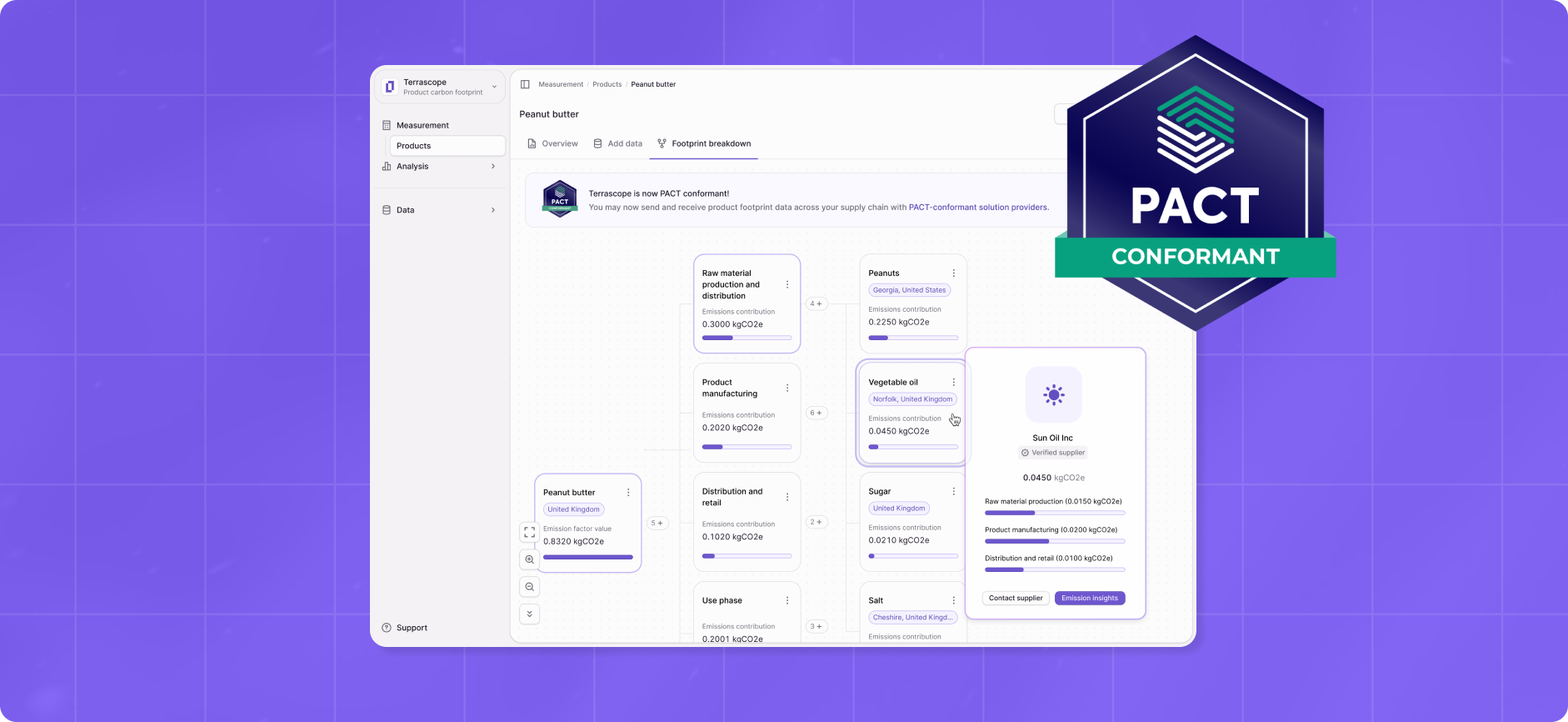

To navigate these complexities, tools like Terrascope can streamline compliance by providing accurate emissions data and analytics tailored to the GHG Protocol.

Terrascope specializes in helping businesses manage Scope 3 emissions, offering detailed insights into their value chain emissions and facilitating informed decision-making. By providing credible, auditable emissions data compliant with the GHG Protocol, Terrascope delivers the carbon-related analytics needed for accurate and timely disclosures.

Terrascope also has proprietary capabilities to track data confidence, visualize emission factors in detail, and simulate changes from reduction initiatives. As California leads the way in climate regulation, it’s imperative for US-based companies to stay ahead of the curve.

Contact us today to learn how Terrascope can support your journey towards effective decarbonization.