Summary

- AASB S2 is currently in force for affected companies, mandating disclosure of only Scope 1 and Scope 2 emissions for now;

- The Corporations Act has been strengthened to also require disclosures to be made via a Sustainability Report;

- Terrascope can help with data ingestion and transformation to allow quick sharing with stakeholders, and also reduce the amount of black boxes for audit time.

Introduction

With the Treasury Laws Amendment Bill 2024 passed in September 2024, mandatory and stringent climate reporting has started to kick in for AASB Group I companies. From the financial year 1 January 2025, companies with Australian operations that meet specific revenue, asset and manpower thresholds will need to begin reporting greenhouse gas emissions and overall climate impact.

Use our guide to navigate the emerging space of sustainability reporting in Australia.

What’s ASRS/AASB/AUASB?

At a glance, the acronyms mean:

ASRS: Australian Sustainability Reporting Standards

AASB: Australian Accounting Standards Board

AUASB: Australian Auditing and Assurance Standards Board (AUASB)

Following the Labour government's 2022 election, Australia aims to reduce greenhouse gas emissions by 43% below 2005 levels by 2030 and achieve net-zero by 2050.

The Treasury Laws Amendment Bill has formalized the ASRS, consisting of AASB S1 and S2, aligning with ISSB’s IFRS S1 and S2. The AASB governs these standards, while the AUASB oversees quality and assurance. AASB S2 mandates climate-related financial risk disclosures, whereas S1 covers general sustainability reporting.

AASB S1 and S2 are different in that S2 is specific to climate-related financial risk, whilst S1 governs sustainability reporting in general. S2 is also mandatory, while S1 is voluntary.

AASB S2, as it pertains to mandatory climate-related disclosures, is what you might be reading this article for. According to the AASB, this Standard, when applicable, requires an entity to disclose information about climate-related risks and opportunities that could reasonably be expected to affect the entity’s cash flows, its access to finance, or cost of capital over the short, medium, or long term.

What's different from existing standards like IFRS S2?

Not too much. AASB S1 and S2 build on the existing IFRS S1 and S2 frameworks. However, they are tailored specifically to the Australian market, and use the Corporations Act (2001) to levy guardrails around making compliance mandatory. Unlike IFRS standards, these are national laws that impose civil penalties for non-compliance.

AASB S2 also removes industry-based metrics mentioned in the IFRS standards, simplifying reporting processes. Similarly, reporting periods are removed in favor of the ASRS’ delayed phase-in.

Who’s covered and what’s the timeline?

Now that we know the basis of these requirements, who exactly needs to comply? Criteria are based on three metrics: consolidated revenue, EOFY consolidated assets, and EOFY consolidated number of employees. The diagram below lays out the details and deadlines applicable to different groups of companies.

Fig. 1: Phases in timeline and criteria of the Treasury Laws Amendment (Financial Market Infrastructure and Other Measures) Bill 2024

Entities that are exempt entirely from lodging financial reports under Chapter 2M of the Corporations Act 2001 (Cth) are excluded from these requirements. However, even companies who do not fall under any of the aforementioned categories should look to embark on emission accounting if they have not already.

When Scope 3 emissions reporting becomes a requirement, there will be increased demand for value chain emission data, spilling over to smaller companies, who in turn have to disclose their own emissions data.

What does it contain and how do you submit it?

Preparing any kind of climate-related disclosures requires entities to provide clear links between the climate risks and their potential impact on the entity’s prospects. Companies must submit an annual ‘sustainability report’ to the Australian Securities and Investments Commission (ASIC).

This contains:- The year’s climate statements;

- any accompanying notes to the climate statements; and

- the directors’ declaration about the statements and notes.

Climate statements and their notes should focus on:

- the entity’s material climate-related financial risks and opportunities;

- the entity’s metrics and targets for the financial year relating to climate that are required to be disclosed by the sustainability standards, including in relation to Scope 1, 2 and 3 emissions of greenhouse gas; and

- any information about the entity’s governance, strategy, or risk management in relation to these risks, opportunities, metrics and targets.

Do I need to get it assured?

After some initial deliberation, the AUASB has worked with the International Auditing and Assurance Standards Board to implement the AUASB standard, ASSA 5000 General Requirements for Sustainability Assurance Engagements. This will take effect on sustainability assurance engagements on or after 1st January, 2025.

For mandatory climate reporting under the Corporations Act, this takes effect through ASSA 5010 Timeline for Audits or Reviews of Information in Sustainability Reports.

Fig. 2: Phases of assurance requirements as given effect through ASSA 5010 Timeline for Audits or Reviews of Information in Sustainability Reports

In Year 1, assurance requirements are the least stringent, with limited assurance needed only for Governance, Strategy, and Scope 1 & 2 emissions disclosures. These begin to kick in more strongly in Year 2 and 3, with limited assurance needed across all components of a Sustainability Report.

Reasonable assurance starts to kick in by Year 4, with all categories being covered and required.

For continuity, the Australian Auditing and Assurance Standards Board's (AUASB) standard ASAE 3410, which governs Assurance Engagements on Greenhouse Gas Statements, will remain in effect until the start of reporting periods beginning December 15, 2026. This standard will continue to be applicable for distinct emissions reporting as mandated by Australia's National Greenhouse and Energy Reporting Act 2007.

What happens if my company does not or cannot comply?

The non-compliance penalties under ASRS and AASB S2 closely mirror financial reporting penalties under the Corporations Act, with civil penalties for directors failing to ensure compliance.

ASIC will adopt a flexible approach during the transition to these new requirements. Companies should proactively prepare their climate reporting systems to accurately measure emissions.

Given the short runway to measure and report Scope 1, 2 and 3 emissions accurately, it is important for companies to act early in preparing their climate reporting systems and processes. Terrascope’s ease of use makes it simple for any clients reporting to the AASB’s requirements to easily ingest and get a top-level overview of your emissions sources. Any data is easily accessible at the time of audit & assurance, keeping your third party verification process easily resolvable.

What does it mean for Australian companies?

Eligible companies must establish climate reporting processes promptly. This includes identifying key climate factors affecting financial prospects and understanding AASB S2 requirements.

AASB is notably stringent on Scope 3 indirect emissions. Scope 3 reporting is mandatory from a company’s second reporting year, on top of the immediate Scope 1 and 2 disclosure requirements.

Scope 3 emissions are infamously difficult to measure, and the stringency and detail required by AASB demands a level of transparency difficult to achieve by manual means.

How can Terrascope help

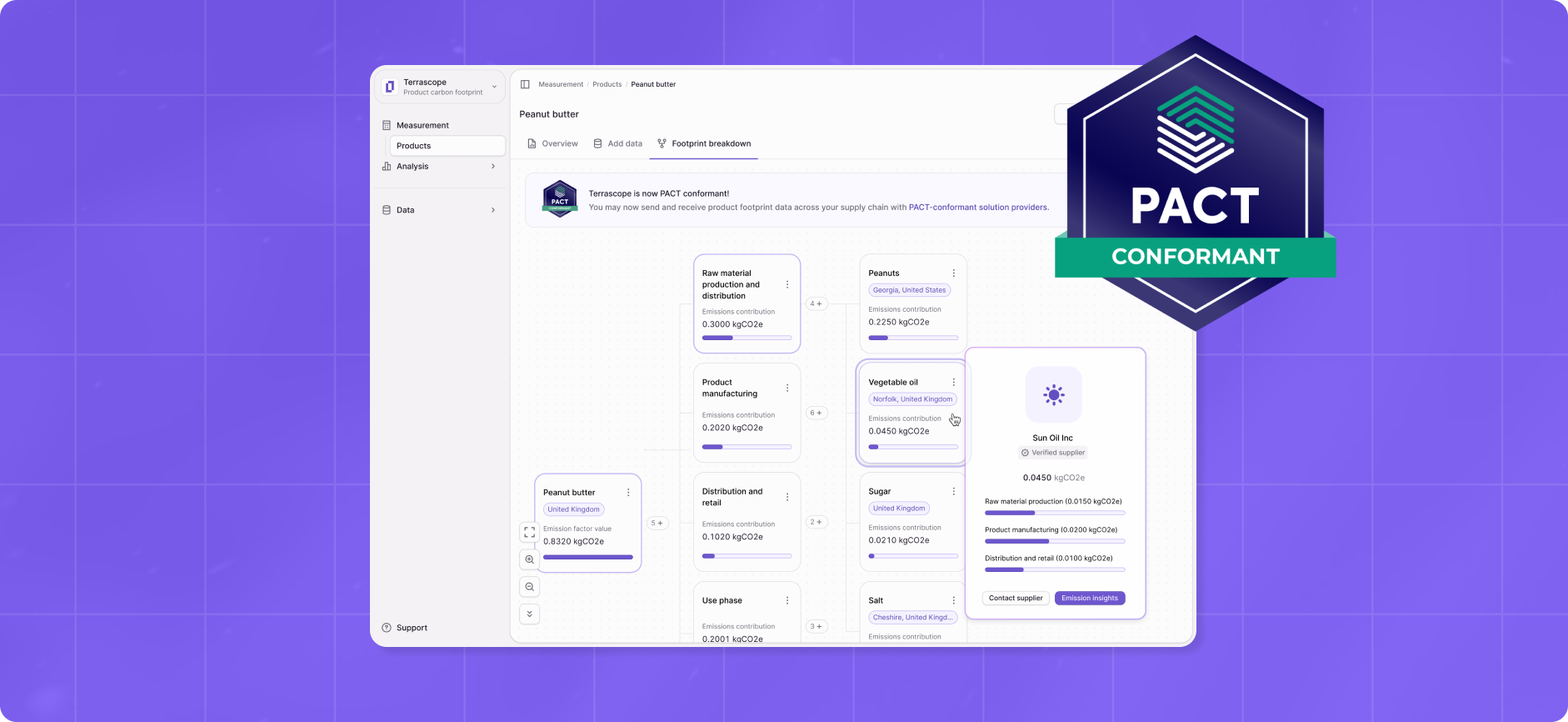

Where Terrascope can help is in our ability to assimilate data from across complex supply chains and fill in data gaps to visualise Scope 1, 2, and 3 emissions. Terrascope supports data in any format, from receipts to itemised invoices, and has several key integrations into SAP, Salesforce, and other platforms used to manage a company’s data. Companies can trust in Terrascope’s ability to provide high-level overviews of your organisation’s emissions, whilst having a transparent, reproducible audit trail.

Unlike other companies, Terrascope works with yours throughout, through to the assurance stage to ensure that your inventory is accurate. By working with Terrascope, businesses can get a thorough understanding of their carbon emissions, broken down by product, geography, process, and more. This, in turn, can drive actionable change in operations and can also help them avoid legal or regulatory penalties.

If your company is preparing for mandatory climate-related financial reporting in Australia, reach us now for a free consultation.