Carbon taxation, stands at the forefront of the fight against climate change. This article explores carbon pricing initiatives worldwide, delving into where and how this mechanism is implemented. As businesses globally confront the urgent need for sustainable practices, understanding the significance of carbon taxes around the world is paramount. Businesses and governments around the globe must understand the challenges, opportunities, and global efforts in mitigating carbon emissions. Companies looking to operate in countries with carbon tax mechanisms stand to benefit from understanding how carbon taxes work.

Where Carbon Is Taxed

Global carbon pricing initiatives are key in the battle against climate change, facilitating a collective commitment to environmental responsibility. Companies across continents are embracing carbon taxation amidst the tightening of carbon tax policies globally, be it cap-and-trade systems or direct carbon taxes. Carbon tax requires emitters to pay a defined amount of tax in accordance with their emissions. On the other hand, an emission trading system (ETS) - also called “cap-and-trade” system - allocates each emitter with an emissions allowance. If an emitter (emitter A) produces more emissions than its allowance, and another emitter (emitter B) produces less emissions than its allowance, emitter A can buy emitter B’s unused allowance to compensate for emitter A’s emissions which exceeded its allowance.

Identifying regions actively engaged in carbon taxation is of paramount importance for companies. By paying attention to countries with carbon tax, companies can tailor strategies towards minimising or mitigating their unavoidable emissions as a baseline. Fostering a more effective global response to climate change involves attentivity to a company’s own materiality, and environmental impact.

Challenges in Carbon Tax

Carbon pricing initiatives, while lauded for their environmental objectives, face several limitations. Such critical analysis of potential drawbacks and limitations is essential for refining carbon pricing mechanisms.

One major challenge lies in accurately pricing carbon to reflect its true environmental cost without causing undue economic strain. As something that impacts the environment or the health of regular consumers, it is difficult to exactly assign a monetary value for carbon emissions. Indeed, the approach that most carbon taxes have enforced is the concept of the “polluter pays” principle coined by the OECD, where a polluter bears all the costs of preventing or removing the pollution that they create. Further guidance has also been given by the World Bank, based on finding the optimal balance between preserving the efficacy of a carbon tax in mitigating environmental impact and mitigating potential economic hardships imposed on companies. Such an effort is a delicate task, requiring careful, strategic policymaking.

Moreover, concerns about carbon leakage, where carbon-intensive industries relocate to regions with lax regulations, highlight the importance of a supranational standardised approach towards. Although there is growing momentum for ETS expansions, with 28 such systems currently in force across the world, up to 45% of global GDP and 83% of global GHG emissions remains out of reach, according to the ICAP’s 2023 Status Report. Indeed, this effort similarly involves a trade-off between energy security and efforts to build a stronger transition. Countries have struggled with this in the face of wider initiatives, but the focus remains on what mitigation strategies can be initiated to deal with some of these neglected emissions.

Opportunities in Carbon Tax

Carbon taxes around the world present several opportunities for businesses, aligning environmental sustainability with economic viability. Here are some key opportunities:

- Capitalising on the transition to carbon neutrality: Through imposing a direct financial cost to each unit of emissions, carbon taxes encourage businesses to transition towards cleaner energy, especially as doing so aligns with environmental goals and leads to operational costs savings. Businesses can enhance their efficiency when it comes to optimising resource use, and reducing waste.

- Green marketing: Businesses can build green credentials by adopting carbon neutral practices in their practices. By becoming certified, or recognised as being conscious of one’s own materiality, these distinguish a company against others, and can enhance brand reputation, attract eco-conscious customers, and open new markets.

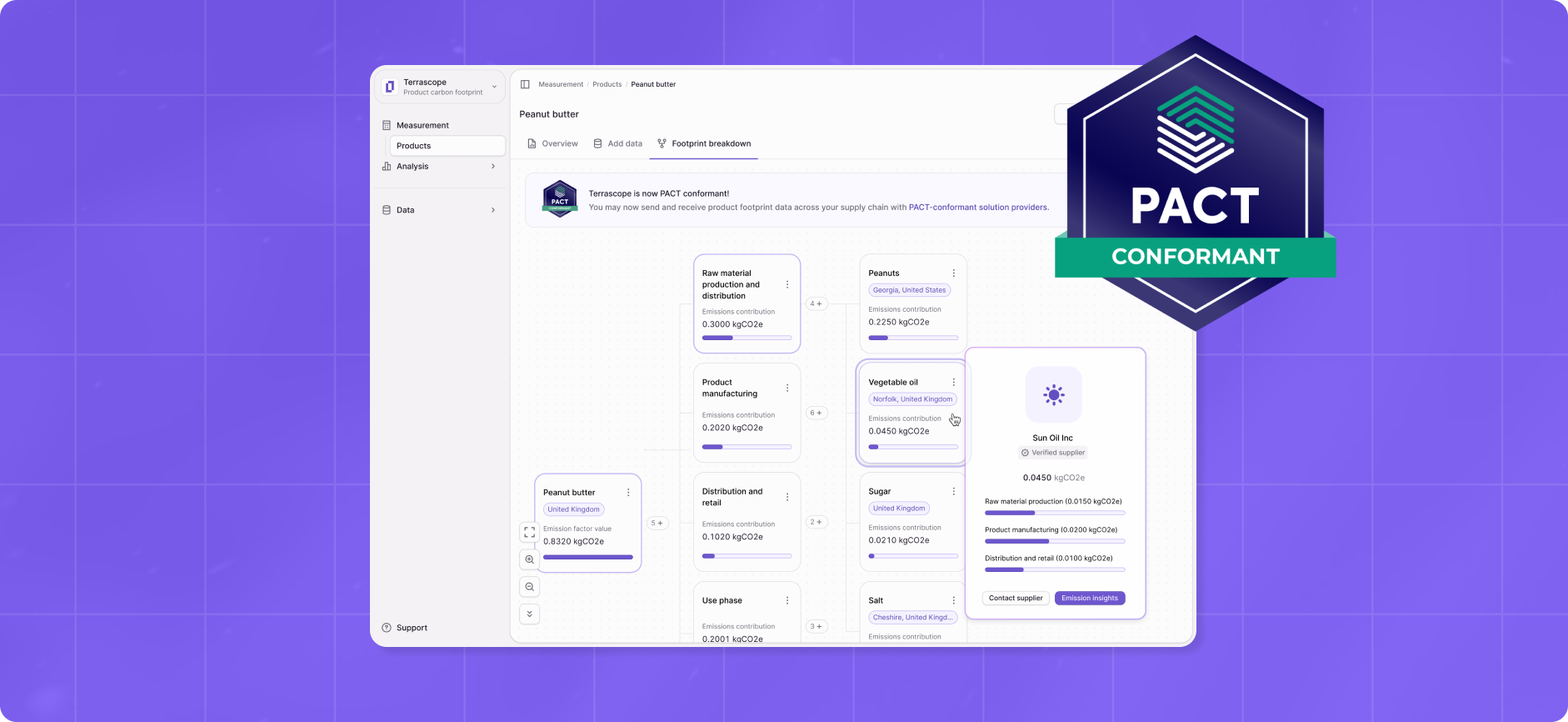

- Building supply chain resilience: Having the ability to appraise one’s own carbon footprint is a sign of a company’s ability to have complete operational visibility. An information-driven approach empowers any business to make prudent, efficient decisions based on the best data possible – turning data into insight, and into real business result.

How Major Players Implemented Carbon Pricing Worldwide

Nations such as Singapore, Australia, the United States, and members of the European Union have adopted diverse approaches to carbon pricing. From cap-and-trade systems to direct carbon taxes, these strategies reflect the unique economic and political landscapes of each region. The role of carbon pricing in these major players varies, with some focusing on internal policies while others engage in international collaborations. China, for instance, has launched the world's largest emissions trading system, emphasising its commitment to carbon neutrality by 2060. In contrast, the European Union's Emissions Trading System (EU ETS) has served as a pioneering model for cap-and-trade mechanisms globally. However, collaboration is the key to sustainable and tangible progress towards net zero. Collaborative approaches, knowledge-sharing, and learning from each other's successes and challenges are integral to crafting a comprehensive and effective global strategy.

Conclusion

In closing, the global pursuit of carbon taxation is the natural next step in the fight against climate change. By navigating the challenges, seizing opportunities, and understanding how major players implement carbon pricing, businesses can build a blueprint for a sustainable future. Terrascope’s end-to-end decarbonisation platform can assist businesses in navigating the complexities of carbon pricing mechanisms around the world.