Summary

- Southeast Asia’s attention to climate change has traditionally trailed behind major developed countries, but the region has, in recent years, started to prioritise decarbonisation with carbon pricing schemes beginning to be trialed across the region.

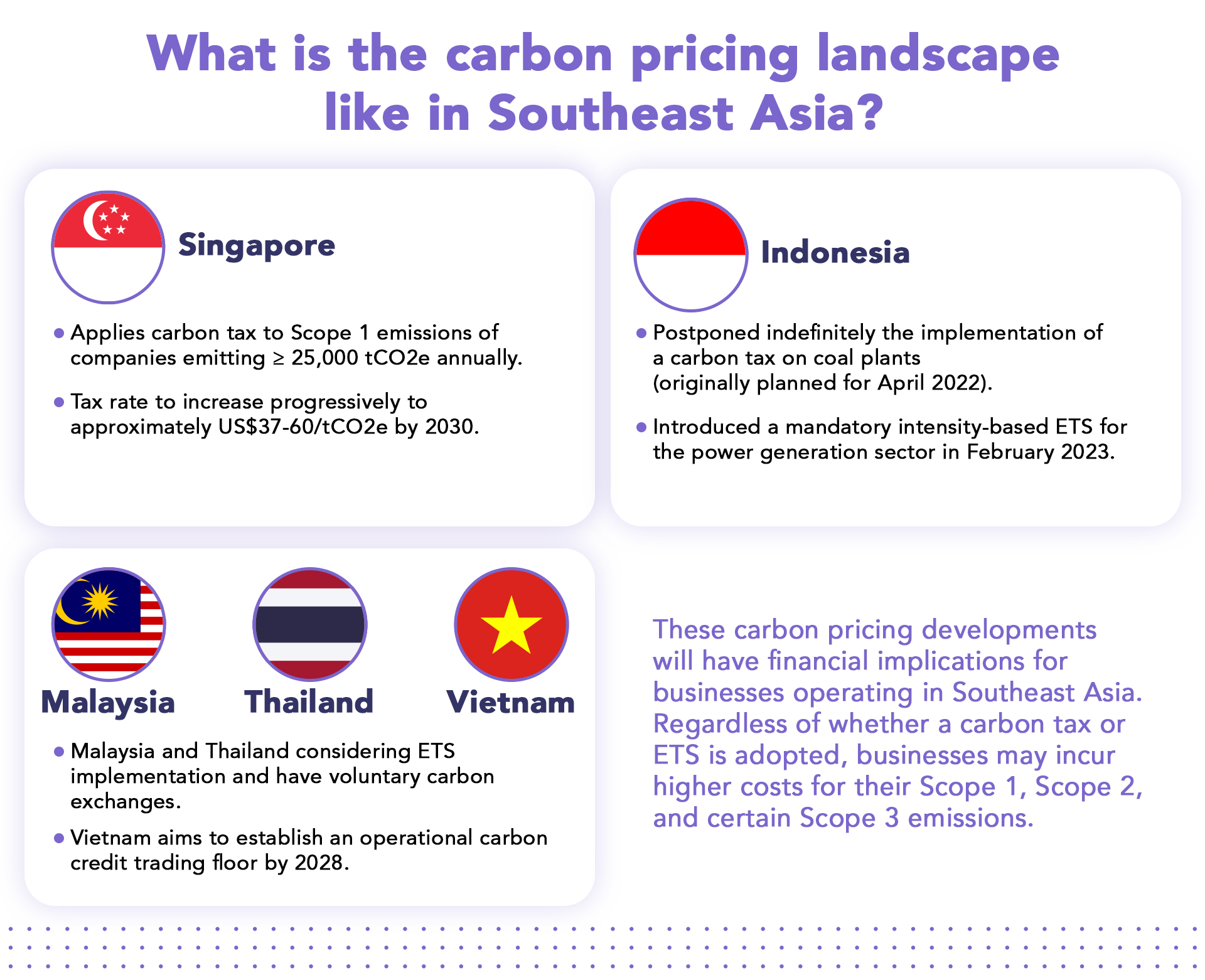

- These carbon pricing developments will have financial implications for businesses operating in Southeast Asia. Regardless of whether a carbon tax or ETS is adopted, businesses may incur higher costs for their Scope 1, Scope 2, and certain Scope 3 emissions.

- Investing in comprehensive carbon measurement and management can help companies respond to carbon pricing regulations more efficiently.

As the world ramps up its decarbonisation efforts to abide by the Paris Agreement, governments in Southeast Asia have started to develop more ambitious climate regulations.

Introduction

Southeast Asia’s attention to climate change has traditionally trailed behind major developed countries, but the region has, in recent years, started to prioritise decarbonisation. This is driven by greater scientific consensus that Southeast Asia is particularly vulnerable to the impacts of climate change, including physical risks such as a rise in sea levels, as well as more frequent and intense extreme weather conditions including cyclones, floods, droughts, and heat waves.

In this series, we highlight some of the key regulatory development in five major Southeast Asian markets - Indonesia, Malaysia, Singapore, Thailand, and Vietnam. We also share insights on potential ways in which these developments may impact businesses, while providing practical suggestions on how industries can better prepare themselves to navigate this dynamic landscape.

We begin this series with a deep dive into carbon pricing.

What is Carbon Pricing?

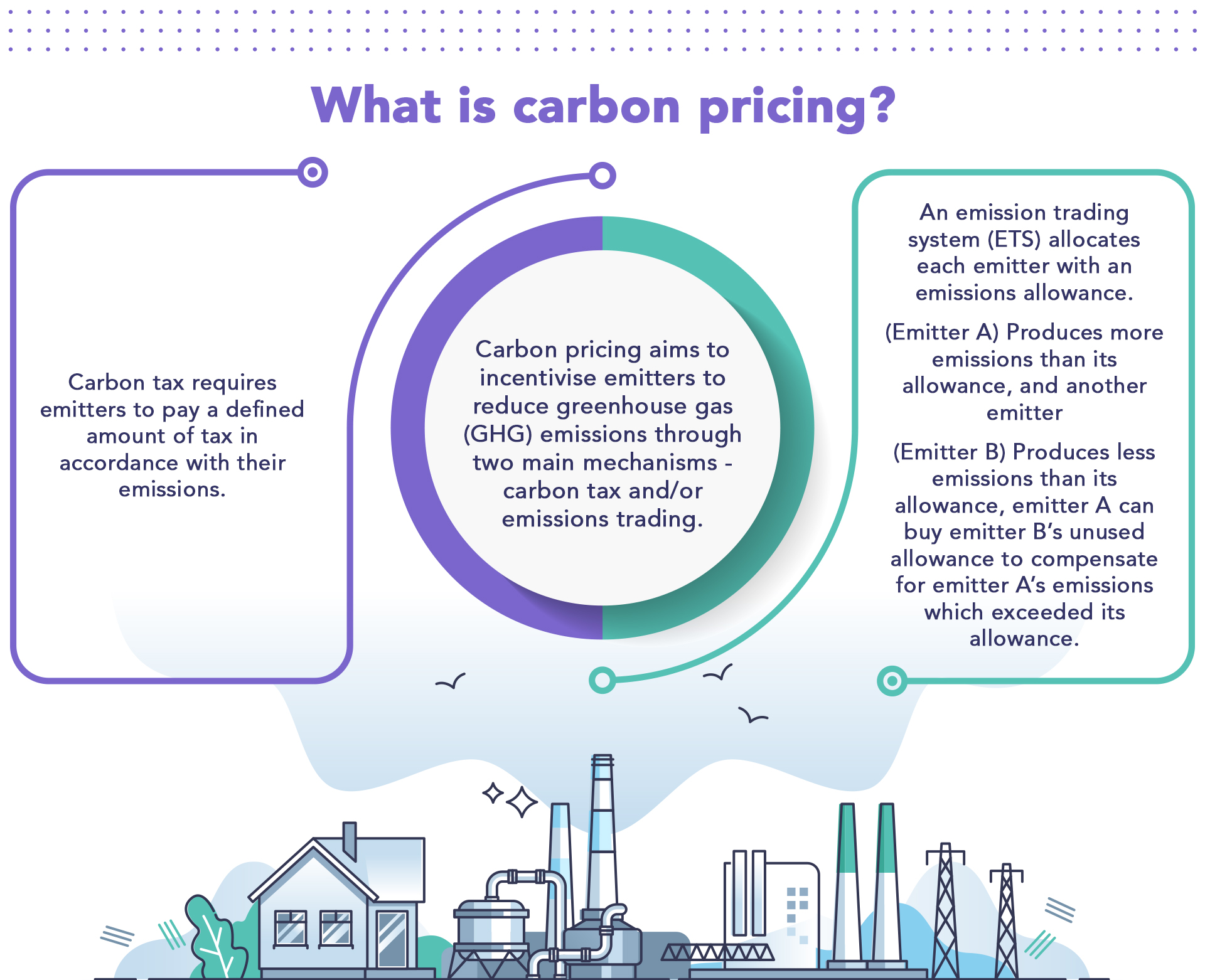

Carbon pricing aims to financially incentivise emitters to reduce their greenhouse gas emissions (GHGs) through two main mechanisms - carbon tax and/or emissions trading. Carbon tax requires emitters to pay a defined amount of tax in accordance with their emissions. On the other hand, an emission trading system (ETS) - also called “cap-and-trade” system - allocates each emitter with an emissions allowance. If an emitter (emitter A) produces more emissions than its allowance, and another emitter (emitter B) produces less emissions than its allowance, emitter A can buy emitter B’s unused allowance to compensate for emitter A’s emissions which exceeded its allowance. More jurisdictions are implementing carbon pricing instruments.

According to a 2022 World Bank report, there are 68 carbon pricing instruments - including carbon taxes and ETSs - in operation, which collectively cover about 23% of total GHG emissions.

The Carbon Pricing Landscape in Southeast Asia

Singapore

Singapore is the first ASEAN country to implement a carbon tax. The tax applies to the Scope 1 emissions of all companies that emit at least 25,000 tCO2e of GHG emissions annually, starting from US$3.70/tCO2e in 2019. While this quantum is low compared to European jurisdictions such as France (US$49.30/tCO2e), it is comparable to other Asian jurisdictions such as Japan (US$2.40/tCO2e). Furthermore, Singapore's carbon tax rate will progressively increase to about US$37-60/tCO2e by 2030. The higher tax rate trajectory provides a clear price signal for businesses to reduce their carbon footprint, while the early announcement gives greater certainty to help businesses plan their investments in decarbonisation strategies and technologies. Notably, the Singapore Government has implemented financial schemes to support businesses’ decarbonisation efforts and increase competitiveness.

Singapore’s carbon tax currently directly applies to about 50 facilities from the manufacturing, power, waste, and water sectors, which account for 80% of its total GHG emissions. This makes Singapore's carbon tax coverage (in terms of share of the country’s total GHG emissions) one of the highest in the world, higher than Japan (around 75% coverage) and France (less than 40% coverage).

Starting from 2024, Singapore will also allow companies to purchase high quality, international carbon credits to offset up to 5% of their taxable emissions. Singapore has two international carbon exchanges which enable the voluntary trading of carbon credits. Nonetheless, Singapore does not have plans to establish an ETS.

Indonesia

Under its Tax Regulation Harmonisation Law (2021), Indonesia - the world’s top coal producer - had originally intended to implement a carbon tax from April 2022, which would have charged US$2.10/tCO2e on coal plants. Though higher commodity prices arising from the war in Ukraine caused an indefinite delay in the tax’s introduction, the Indonesian Government remains fully committed to its implementation.

In February 2023, Indonesia announced the launch of a mandatory, intensity-based ETS for its power generation sector. Set to be implemented in three phases, the first phase (2023-2024) will cover coal plants whose production capacities exceed 100 MW (accounting for 81% of Indonesia’s power generation capacity). The subsequent phases - from 2025 to 2030 – will expand the ETS coverage into oil and gas plants as well as other coal plants that are not connected to the national grid. The government will establish intensity targets to determine the number of allowances to be received by each facility for every MWh of electricity generated. Facilities covered by the ETS are expected to be allocated with an estimated 20 million tCO2e carbon allowances in total. Under this new ETS, which will function as a hybrid “cap-tax-and-trade” system, facilities that fail to meet these obligations will be subject to a tax - the rate of which will eventually be linked to the price of the domestic carbon market.

Malaysia, Thailand, and Vietnam

Thailand, Vietnam, and Malaysia have not adopted carbon pricing but changes may be on the horizon. Malaysia and Thailand are considering putting ETS into effect and have already established voluntary carbon exchanges. Both countries are also looking into implementing a carbon tax, although specific details have not been announced. Vietnam’s revised Law on Environmental Protection – which took effect in January 2022 – legalised the establishment of a carbon market. It aims to officially operate a carbon credit trading floor by 2028; by which time, businesses that cannot reduce their carbon emissions will have to either purchase carbon credits or face administrative fines.

How Does Carbon Pricing Affect Your Business?

These carbon pricing developments will have financial implications for businesses operating in Southeast Asia. Regardless of whether a carbon tax or ETS is adopted, businesses may incur higher costs for their Scope 1, Scope 2, and certain Scope 3 emissions. For instance, even though the Singapore carbon tax only applies to Scope 1 emissions by companies in the manufacturing, power, waste, and water sectors, companies in other sectors would also indirectly face a carbon price on their Scope 2 emissions (arising from the electricity they consume). This is because power generation companies are expected to pass on some tax burden through increased electricity tariffs.

How Do You Prepare Your Business for These Regulatory Developments?

Businesses can prepare for these regulatory developments by taking the following three practical steps:

- Measure GHG emissions: Businesses may wish to start by building a comprehensive emissions inventory, including direct and indirect emissions across the value chain. To measure Scope 3 emissions, businesses will need access to data from their suppliers and partners. One way to do this is through utilising technology platforms to consolidate and standardise data collection.

- Detect emission hotspots: It is crucial for businesses to identify the activities that contribute the most to their carbon emissions. According to the GHG Protocol, there are 15 categories of Scope 3 emissions that cover both downstream and upstream activities of a company. Yet, typically only a few activities contribute to a majority of emissions. For example, purchased goods and services account for 63.35% of total emissions in the agricultural commodities industry and use of sold products account for 90% in the capital goods sector. Identifying your business’ emission hotspots will allow you to plan where to focus your investments and initiatives to yield the best results.

- Reduce emission levels: Businesses will find it useful to simulate the results of different initiatives to facilitate comparison between these initiatives. Businesses should also aim to drill-down into the composition of specific products to examine all possible ways to improve the carbon footprint of these products. Finally, businesses should monitor their initiatives, to help them better plan for the next cycle of emissions reduction measures.

How can Terrascope help?

Terrascope is an enterprise grade, end-to-end decarbonisation SaaS platform that helps large enterprises comprehensively measure and manage their carbon emissions.

By combining data science, machine learning, and sustainability expertise, Terrascope provides large companies with data analytics and digital tools they need to effectively decarbonise their operations and supply chains.

- Terrascope enables your business to measure Scope 1, Scope 2, and Scope 3 emissions quickly, accurately, and comprehensively. Today, businesses encounter error rates of approximately 40% when measuring their emissions baselines, and fewer than 10% of companies are able to measure their emissions accurately.

- Terrascope can help your business identify emission hotspots. Terrascope’s platform enables businesses to break down their by scope, geographic location, business unit, process, and more to achieve focused insights on hotspots and next best actions. Businesses can create visualisations for business stakeholders and teams to drive shared ownership and collaboration for action.

- Terrascope can help your business decide on the most effective initiatives to reduce emissions and costs. With accessible “What-if” simulations, Terrascope users can compare the amount of emissions reduced from different initiatives, and make better decisions based on their business’ needs. These simulations can be generated self-service on the platform, or through advisory from Terrascope’s Climate Experts. For example, an international agricultural firm was shipping raw materials directly from Africa to Japan for processing. Using Terrascope, the firm found out that shipping the raw material from Africa to Singapore for processing, then to Japan, would reduce its emissions by 25%. This is because Singapore has lower electricity emission factors and processing in Singapore reduced weight in turn, resulting in lower transportation-related emissions. Terrascope’s platform can also help users drill-down into the composition of specific products to understand and visualise emissions. Finally, Terrascope’s platform includes an initiative tracker for businesses to monitor their reduction initiatives.